When building a fintech product companies often face the dilemma of choosing the right programming language. Ruby, Python, Java or C – they all have their strengths and weaknesses, so the choice could be quite difficult. In my mind, you should decide on the technology depending on the area of your fintech product to choose the language best suited to your needs.

What do the numbers say?

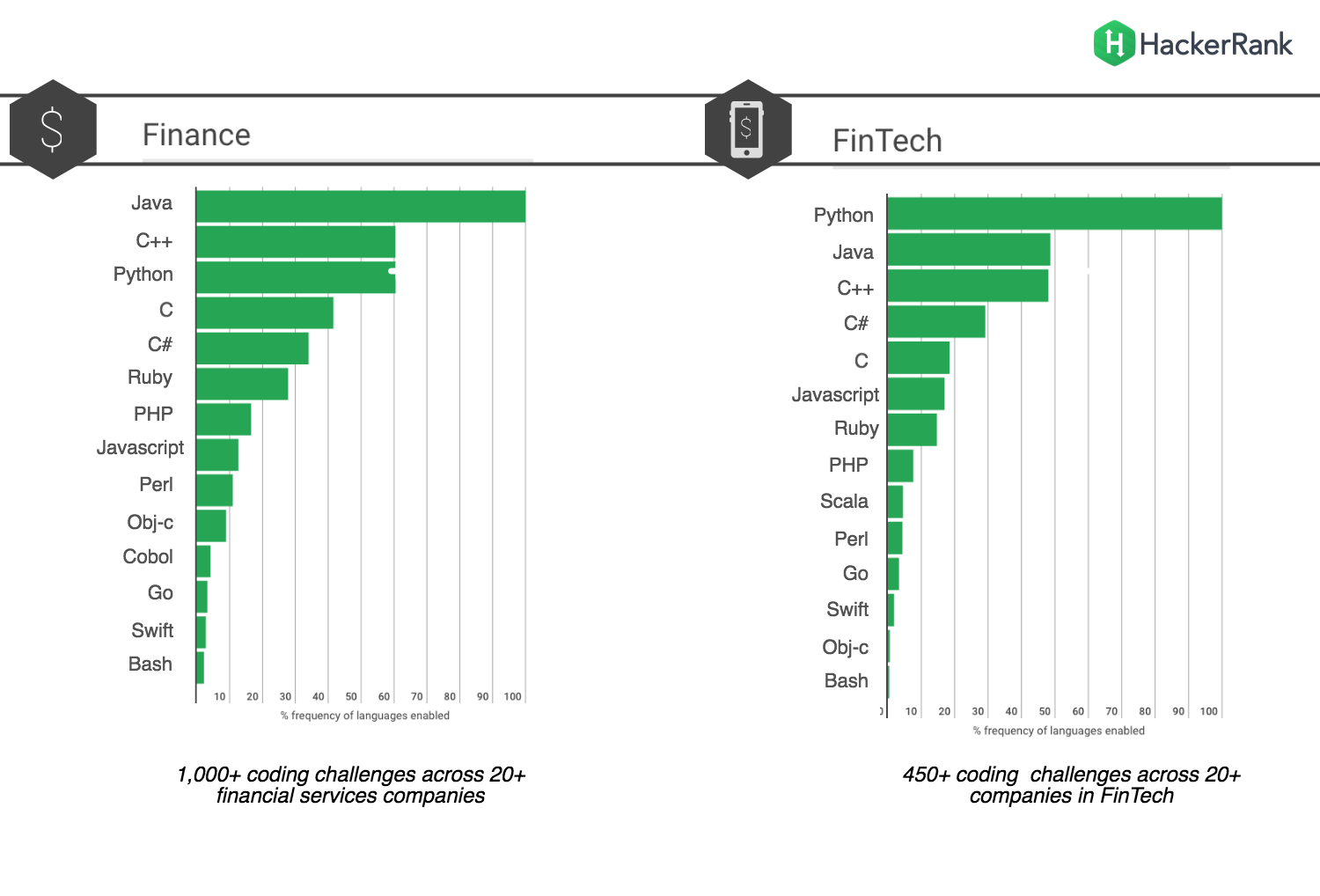

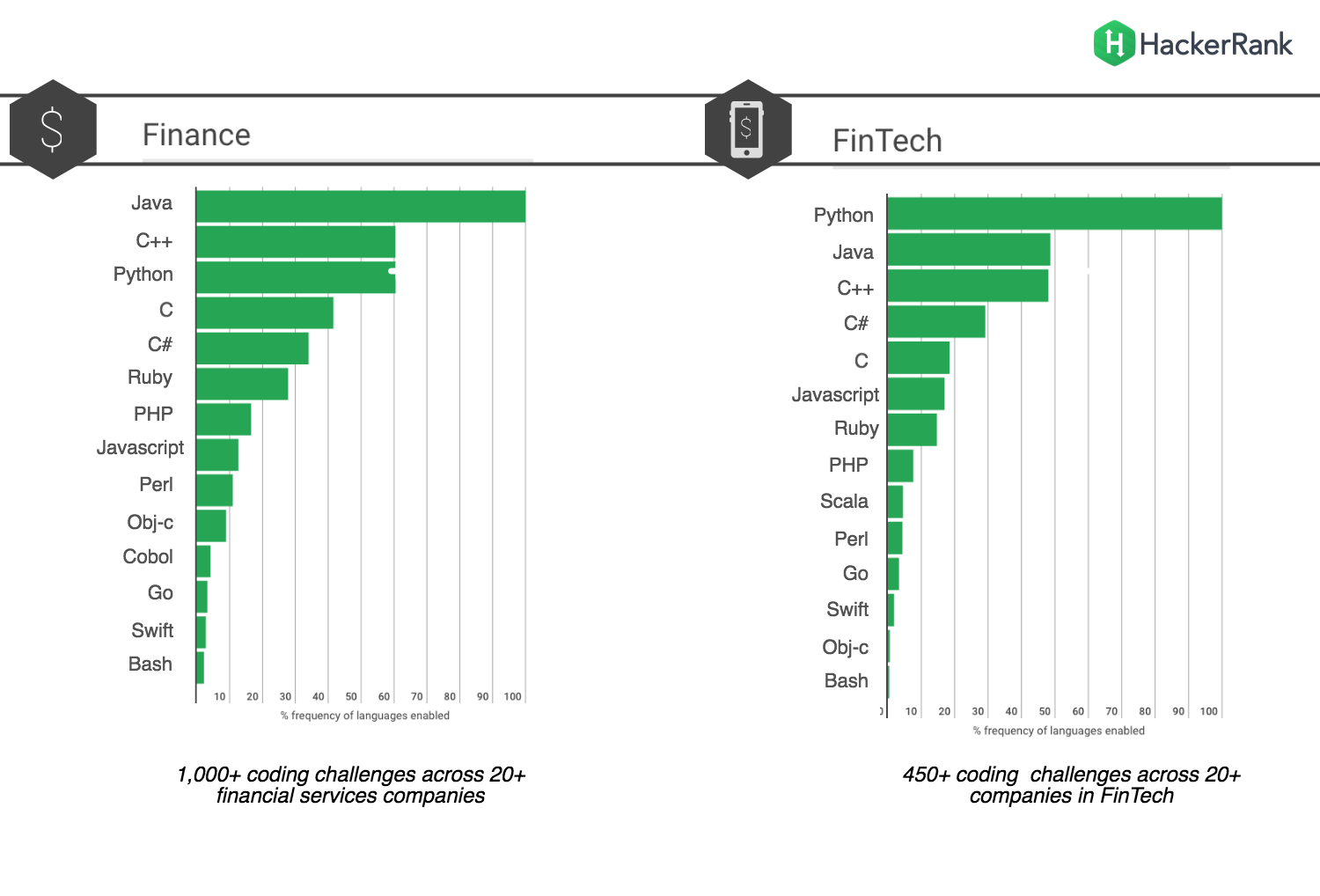

Python or Java have been among the most-used languages for several years, also when it comes to developing fintech products. HackerRank has prepared a ranking, showing that those two languages and C ++ are the most popular considering this industry. The seventh position in this list is taken by Ruby; in 2019, it occupied the tenth place in the Stack OverFlow’s general list of the most used programming languages.

source: HackerRank

Can Ruby be a better choice than even Python?

I am mentioning Ruby for a reason. This is one of our core technologies at Codest (we are a software development company), which is why we know the strengths of this language very well; in the case of fintech projects, this programming language works great. Although Python is seen as the fastest-developing language in finance in general, Ruby can be a valuable alternative. Why? Let’s compare the most important features of both programming languages in relation to the development of fintech products.

Ruby

Advantages:

-

Powerful framework. Rails is the most popular Ruby framework. Its biggest advantage is the simplicity of writing the code. It is also worth noting that it has a large number of extensions and modules, which greatly facilitate the work of the programmer.

-

Saved time and rapid development. Using the newest programming tools, both Ruby and Ruby on Rails boost the time efficiency of the implemented projects. Whilst creating a web application, its first functionalities can be obtained much faster and with less effort than in comparison to other programming languages.

-

Flexibility. Ruby does not limit a programmer but gives the possibility of modifying or deleting code at any time. If the client asks you to change a given functionality, the task can be achieved in a relatively short time.

-

Safety. This factor has a crucial role in building fintech products. As for the Ruby on Rails framework, Ruby provides mechanisms that increase application security – a built-in protection against XSS, CSRF and SQL Injection attacks, which are considered to be one of the most notorious attacks on web applications.

5. Short way to MVP. The Rails framework allows for very fast creation of a basic product containing the most important functionalities that a customer can verify.

Python

Advantages:

-

Scalability. Python, like Ruby, is considered to be a programming language with which you can create a working application in a very short time.

-

Speed and efficiency. Working with Big Data in Python is relatively fast and efficient. It is a very developed programming language that ensures the highest standards of data preparation, so your product should work efficiently and quickly.

-

Easy code maintenance. The Python code is readable, which makes it also low-maintenance – the number of changes you will have to make in the future will not be large.

-

A rich library. Python contains a rich set of built-in and portable options. Such a library allows you to handle many programming tasks at the application level, from pattern matching to network scripts (by script we mean a program that does not require a phase of transformation from text to executable).

-

Communication with other parts of the application. Python communicates efficiently with other parts of the application, all due to the use of numerous integration mechanisms.

…but why Ruby for fintech product?

In addition to the many advantages I have already mentioned, I would like to address the most common allegation against Ruby. Some say that the language’s disadvantage is the documentation. However, I think Ruby is so “expressive” that you don’t need documentation for the “old” code to be able to read it. In addition, the “old”, undocumented code is not entered into the project; a developer should write the new or previously working code and then directly implement improvements.

I strongly believe that Ruby is a good choice for the development of fintech products. And we can find many confirmations in the form of the rapidly growing fintech companies that based their technology on Ruby. Here is an example shortlist:

Fintech companies based on Ruby:

CoverWallet

Headquarters: New York

About the company: CoverWallet combines deep analytics, thoughtful design and state-of-the-art technology to help small businesses with all their insurance needs. CoverWallet delivers a seamless user experience while offering savings, customized coverage and best-in-class service to their customers.

EveryPay

Headquarters: Tallin

About the company: EveryPay offers a fully cloud-based payment gateway platform for banks and acquirers. It gives them access to state-of-the-art and continuously improving digital payment solutions with all the relevant tools to manage the acquiring side of eCommerce.

QuickPay PSP

Headquarters: Aarhus

About the company: QuickPay is a secure and dynamic payment service provider that facilitates more than 10,000 merchants across most of Europe. It allows them to accept a broad spectrum of credit cards and other payment methods.

InBank As

Headquarters: Tallin

About the company: Inbank is a consumer finance-focused digital bank with an EU credit institution license, active in seven countries. They currently have approximately 400,000 client contracts, providing consumer financing and deposit products.

CrowdDesk

Headquarters: Frankfurt

About the company: CrowdDesk offers companies fully digitized funding-as-a-service solutions for the online raising of capital. These can be tailored to the individual needs of customers.

creditshelf

Headquarters: Frankfurt

About the company: creditshelf has been providing finance services for small and medium-sized businesses for years – simple, fast, innovative. The credit analyses are quick and easy for customers because of the technology developed by creditshelf.

PAIR Finance

Headquarters: Berlin

About the company: PAIR Finance is the leading AI-based fintech for debt collection and receivables management. The company provides business customers with innovative technology, modern behavioral analyses and data science to return lost sales from unpaid invoices – digital, efficient and customer-oriented.

COMPEON

Headquarters: Dusseldorf

About the company: COMPEON is the only independent full-service provider for SME financing in Germany. Companies and their consultants, freelancers and the self-employed can quickly find the best financing solution for their project on this platform.

Whitebox

Headquarters: Freiburg

About the company: Whitebox is one of the leading bank-independent digital asset managers in Germany. The company offers active portfolio management based on the value approach. Whitebox invests primarily in undervalued asset classes that are mapped with low-cost, exchange-traded index funds (ETF).

How about Java?

Java is known to be a very flexible language used in various types of projects such as fintech. It also performs perfectly in blockchain, cloud computing, IoT, AI, ML and so on. The potential of Java is still being discovered but this programming language surely has a lot to offer.

Advantages:

-

Affordable. Java programs are on the less pricer side when it comes to development and maintenance as they run on specific hardware infrastructure.

-

Platform independence. Java is a type of WORA language (write once, run anywhere). This means that a programmer can develop code in one system and be sure that it will run on other Java-enabled systems.

-

Stability. Java is one of the most stable languages. What’s more the newest updates aim at making it even more stable.

-

Multithreading. It’s a multithreaded language, which means that more than one thread can be run at the same time – it increases the performance of the application.

-

Simplicity. Java is considered to be a less complex programming language such as C++ and C.

Summary

If you ever have to decide about the proper technology and programming language to develop your fintech product, keep in mind the above breakdown and remember that Python is not the only option. As you could notice, Ruby is also a great choice for the whole fintech industry, as proven by its many advantages and real examples of well-prospering businesses that use this language.

If you have any questions related to your fintech product, feel free to reach me and schedule a quick call to discuss your doubts.

Read more:

7 Startups & Scaleups that Will Shake the Marketplace Scene in 2022

3 Common Challenges of Software Product Development for Startups